Habitat for Humanity Saskatchewan

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

D+

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

60%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 60 cents are available for programs.

My anchor

OVERVIEW

About Habitat for Humanity Saskatchewan:

Habitat for Humanity Saskatchewan is a one-star charity with low demonstrated impact. It is not financially transparent and has a low results reporting grade. For every dollar donated to the charity, 60 cents are available to go to the cause, which is outside Ci's reasonable range. Read Ci's report before donating to this charity.

Founded in 2021 through the merger of Habitat Regina, Habitat Saskatoon, and Habitat Prince Albert, Habitat for Humanity Saskatchewan (Habitat Saskatchewan) helps to provide low-income families with affordable housing. Habitat Regina, the primary chapter of Habitat Saskatchewan was founded in 1993. Habitat Saskatchewan is one of Habitat for Humanity Canada’s 46 local affiliates that work toward a country where everyone has a safe and stable place to live. The charity has three main chapters in Regina, Saskatoon, and Prince Albert; and four small chapters in Estevan, Yorkton, Moose Jaw, and Melfort. Habitat Saskatchewan's small chapters help the charity build homes, fundraise, and partner with families in need of affordable housing.

Habitat Saskatchewan’s main program is homeownership. The program helps low-income families buy affordable homes. The charity raises funds for land and materials to build new houses. Habitat Saskatchewan sells its homes to eligible families with no down payment required, financed through interest-free mortgages paid over 20 years. To keep homes affordable, Habitat Saskatchewan caps these mortgage payments at 25% of annual household income. The charity also requires each family to contribute 500 hours of “sweat equity” by volunteering to build homes or working at Habitat ReStores. Habitat Regina receives mortgage payments through a revolving fund used to finance future building projects. Since founding, Habitat Saskatchewan states that it has helped over 200 families become new homeowners.

Habitat Saskatchewan provided no information on its main chapters. The charity reports that its Estevan chapter is building its second home, its Yorkton chapter is building its eighth home, and its Moose Jaw chapter is building its ninth home.

ReStore is Habitat for Humanity’s retail store that accepts donations of overstocked or used discontinued items and usable building materials. ReStore then sells the donated items to the public at a reduced cost. Habitat Saskatchewan has three ReStore locations located in Regina, Saskatoon, and Prince Albert.

My anchor

Results and Impact

Habitat Saskatchewan has yet to release an annual report since its founding. Ci could not find any quantified results on Habitat Saskatchewan. This may not be a complete representation of Habitat Saskatchewan’s results and impact.

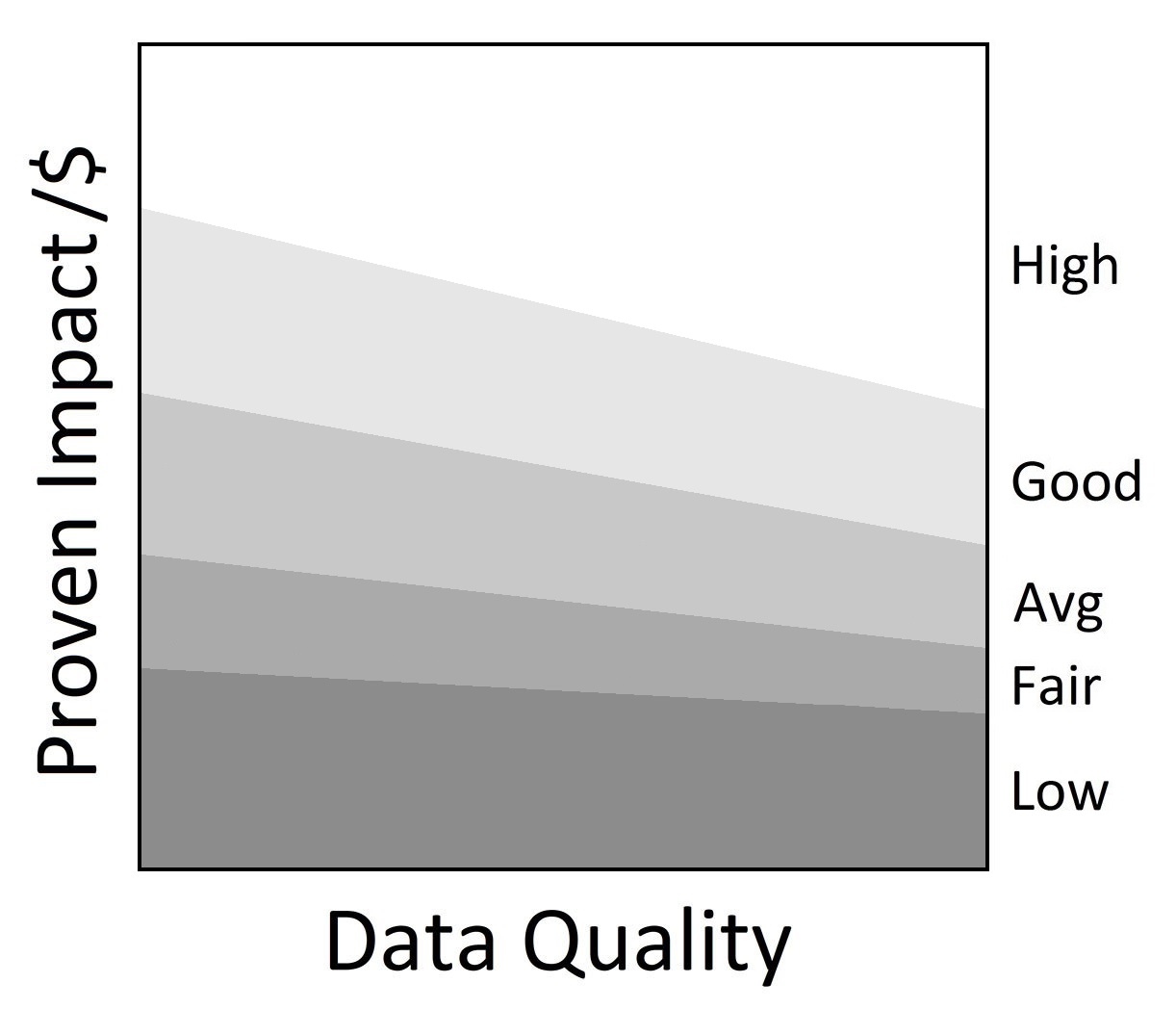

Charity Intelligence has given Habitat for Humanity Regina a Low impact rating based on its demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

Habitat Saskatchewan received $773k in donations in F2022. This is a 26% decrease compared F2021 where the charity received $1.0m in donations. It also received $1.9m in fees for service (mortgage payments from families, amounting to 42% of total revenue) and $751k in government grants (19% of revenue) during the year.

Habitat Saskatchewan does not report on fundraising in F2022 and F2021 in its audited financial statements and its T3010 filing with the CRA. Administrative costs are 40% of revenue. This results in total overhead spending of 40%. For every dollar donated to the charity, 60 cents are available to go to the cause. This is outside of Ci’s reasonable range for overhead spending, which has been the case for the past five years.

Habitat Saskatchewan’s funding reserves are shown as negative since its interest-bearing debts of $6.4m exceed its cash and investments of $966k. This is common for Habitat for Humanity chapters across Canada, which hold mortgages for first-time homeowners. Excluding interest-bearing debts, Habitat Saskatchewan’s gross reserve funds can cover 18%, or two months of its annual program costs.

Charity Intelligence has sent this update to Habitat for Humanity Saskatchewan for review. Changes and edits may be forthcoming.

Updated on July 26, 2023 by Liam Chapleau.

Financial Review

Fiscal year ending December

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 39.8% | 45.5% | 41.8% |

| Fundraising costs as % of donations | 0.0% | 0.0% | 17.1% |

| Total overhead spending | 39.8% | 45.5% | 58.8% |

| Program cost coverage (%) | (98.0%) | (76.0%) | (193.2%) |

Summary Financial StatementsAll figures in $s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 772,666 | 1,042,197 | 1,641,177 |

| Goods in kind | 0 | 3,300 | 1,589,431 |

| Government funding | 835,616 | 1,228,605 | 759,150 |

| Fees for service | 1,887,083 | 1,392,639 | 0 |

| Business activities (net) | 925,919 | 921,785 | 226,035 |

| Other income | 68,769 | 114,633 | 162,328 |

| Total revenues | 4,490,053 | 4,703,159 | 4,378,121 |

| Program costs | 5,533,261 | 8,571,420 | 3,405,719 |

| Administrative costs | 1,787,520 | 2,139,704 | 1,828,209 |

| Fundraising costs | 0 | 0 | 280,080 |

| Total spending | 7,320,781 | 10,711,124 | 5,514,008 |

| Cash flow from operations | (2,830,728) | (6,007,965) | (1,135,887) |

| Capital spending | 17,169 | 14,224 | 128,618 |

| Funding reserves | (5,424,264) | (6,516,605) | (6,580,052) |

Note: To better reflect Habitat Saskatchewan’s homeownership program, Ci included mortgage payments received in fees for service. This affected revenue by $1.9m in F2022, $1.3m in F2021, and ($nil) in F2020 as the charity did not disclose this information. To report on a cash basis, Ci included deferred funding within other revenue, impacting revenue by ($85k) in F2022, ($85k) in F2021, and ($85k) in F2020. Ci included net ReStore operations (excluding amortization) in business activities, affecting revenues and expenses by ($1.3m) in F2022, ($1.5m) in F2021, and ($nil) in F2020. Habitat Regina’s audited financials do not separate costs of home sales from costs of building operations. As such, Ci included all costs of home sales and building operations in program costs to account for building costs, impacting expenses by $5.3m in F2022, $8.0m in F2021, and $3.0m in F2020.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

2 |

$40k - $80k |

8 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2021

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 306-522-9700