Junior Achievement of Canada

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔+

FINANCIAL TRANSPARENCY

Audited financial statements for current and previous years available on the charity’s website.

A

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Fair

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

85%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 85 cents are available for programs.

My anchor

OVERVIEW

About Junior Achievement of Canada:

Junior Achievement of Canada is a 3-star charity with an above-average results reporting score. Its overhead costs are within Ci’s reasonable range, and it has reserve funds to cover program costs for almost eight months.

Founded in 1955, Junior Achievement Canada (JA Canada) aims to inspire youth and prepare them to succeed in a global economy. The charity’s national office is in Toronto. JA Canada runs programs for elementary, middle, and secondary school students. The programs have three pillars: financial literacy, work readiness, and entrepreneurship.

JA Canada’s Financial Literacy programs help students learn to create and manage wealth by developing budgeting, investing, and financial planning skills. The charity’s Work Readiness programs teach students career-building skills, including communication, networking, interviewing, and collaboration. JA Canada’s Entrepreneurship programs allow students to gain experience in running a successful business. The programs also teach students to create business plans, innovate, and manage teams.

In F2022, JA Canada reported 1,912,816 student learning hours. The charity reached 272,035 students across 4,556 schools.

My anchor

Results and Impact

In 2011, The Boston Consulting Group (BCG) conducted a year-long study to measure the value of JA's programs in Canada. The study found that JA Canada's work has a direct impact of $105 million on Canada's economy each year. It reports that for every $1 received, JA Canada creates an annual return to society of $45. BCG states that JA Canada's alumni are 50% more likely than the average Canadian to open their own business. Additionally, alumni are three times more likely to hold senior and middle management positions within their organisations. The study found that 65% of Achievers said that the charity had a significant impact on their decisions to stay in school and enrol in post-secondary education.

While Ci highlights these key results, they may not be a complete representation of JA Canada's results and impact.

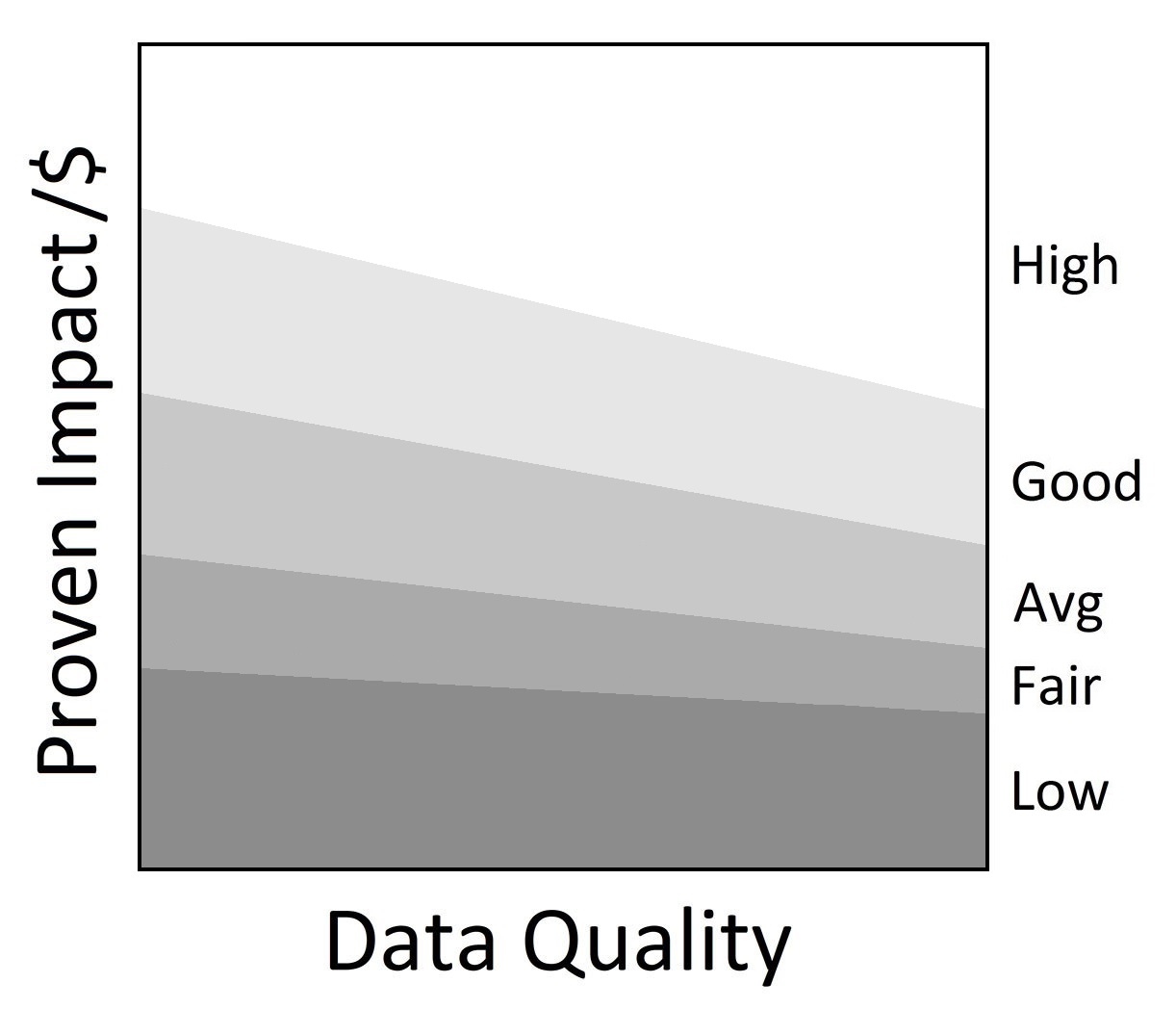

Charity Intelligence has given Junior Achievement Canada a Fair impact rating based on demonstrated impact per dollar spent.

Impact Rating: Fair

My anchor

Finances

Junior Achievement of Canada received $5.1m in donations and special events revenue in F2022.

Administrative costs are 8% of revenues and fundraising costs are 7% of donations. This results in total overhead spending of 15%. For every dollar donated, 85 cents go to the cause. This is within Ci’s reasonable range for overhead spending.

JA Canada has reserve funds of $2.9m. The charity can cover almost eight months of annual program costs with its existing reserves.

According to the charity’s T3010 filing with the CRA, Junior Achievement of Canada granted $2.0m in F2022 to the Junior Achievement members across the country.

This charity report is an update that has been sent to Junior Achievement of Canada for review. Changes and edits may be forthcoming.

Updated on May 26, 2023 by Kiara Andrade.

Financial Review

Fiscal year ending June

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 8.4% | 9.2% | 10.9% |

| Fundraising costs as % of donations | 6.5% | 8.7% | 7.3% |

| Total overhead spending | 14.9% | 17.9% | 18.2% |

| Program cost coverage (%) | 64.0% | 62.7% | 56.6% |

Summary Financial StatementsAll figures in $000s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 3,787 | 2,941 | 3,924 |

| International donations | 112 | 303 | 164 |

| Government funding | 245 | 490 | 341 |

| Special events | 1,301 | 615 | 0 |

| Other income | 454 | 441 | 544 |

| Total revenues | 5,899 | 4,790 | 4,972 |

| Program costs | 2,466 | 2,081 | 1,714 |

| Grants | 2,001 | 1,848 | 1,840 |

| Administrative costs | 496 | 439 | 542 |

| Fundraising costs | 329 | 309 | 288 |

| Other costs | (11) | 9 | 22 |

| Total spending | 5,280 | 4,686 | 4,406 |

| Cash flow from operations | 619 | 104 | 567 |

| Capital spending | 337 | (719) | 662 |

| Funding reserves | 2,858 | 2,463 | 2,013 |

Note: To report on a cash basis, Ci adjusted for deferred donations, affecting revenues by $106k in F2022, ($876k) in F2021 and $590k in F2020. Ci adjusted for deferred capital contributions, affecting revenues by $209k in F2022, $586k in F2021 and ($220k) in F2020. Ci reported international donations and provincial government funding from the charity’s T3010, and removed the respective amounts from Canadian donations. Ci reported spending on grants from the charity’s T3010 and removed the respective amounts from program costs.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

1 |

$160k - $200k |

2 |

$120k - $160k |

1 |

$80k - $120k |

3 |

$40k - $80k |

3 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 416-622-4602